By Atoyebi Nike

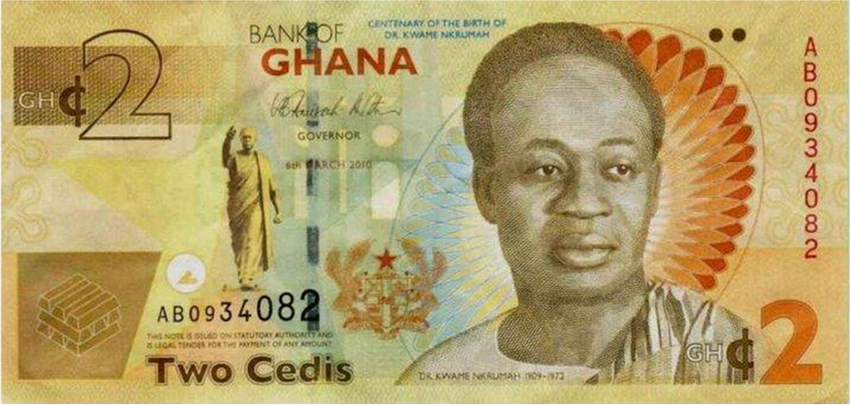

The Ghanaian cedi has emerged as the top-performing currency globally so far in 2025, appreciating by more than 25 percent against the U.S. dollar. But despite the headline-grabbing surge, financial analysts are warning that the rally reflects a post-crisis recovery, not a sign of long-term economic strength.

According to Bloomberg data, the cedi’s impressive rebound stands in stark contrast to its 2022 collapse, when it lost over 55 percent of its value during a period of inflationary pressure, rising public debt, and concerns over fiscal governance.

The rally has since prompted Fitch Ratings to upgrade Ghana’s foreign-currency issuer rating from ‘Restricted Default’ to ‘B-’, a move analysts interpret as a sign of renewed investor confidence. However, many experts argue that currency appreciation in a developing economy requires closer scrutiny.

“This is more of a bounce-back than a fundamental turnaround,” said Johnson Chukwu, CEO of Cowry Asset Management. “While the cedi has outperformed some of its African peers in recent years, the context is crucial—it’s still recovering from deep losses, not establishing new strength.”

Chukwu noted that the cedi’s recent gains have not yet reached levels that would hinder export competitiveness. “We’ve not yet hit the point where the appreciation becomes a structural problem for trade,” he added.

Behind the cedi’s climb are policy efforts under a $3 billion IMF Extended Credit Facility, alongside windfall revenues from gold and oil exports. These gains have supported external reserves and bolstered foreign exchange availability.

Marvellous Adiele, a portfolio manager at Parthian Capital, pointed to local monetary interventions: “The government’s policy requiring domestic gold purchases in cedi has helped boost FX reserves and reduce pressure on the exchange rate.”

Still, underlying fragilities remain. A shortage of U.S. dollars in Ghana’s banking sector is beginning to exert new stress on the currency. As of May 2025, the cedi traded around GH¢10.28 to the dollar, with demand for greenbacks rising and local dollar liquidity drying up.

Analysts caution that the recent appreciation, while welcome, could easily unravel if macroeconomic reforms stall or global commodity prices reverse. The story of Ghana’s cedi, they say, is far from over.